Decatur Township Assessor

Property Assessment Appeal Process Guide

General Information

Property taxes are levied, collected, and spent locally to finance a major portion of the services that units of local government provide to their residents. The amount you pay in taxes is dependent upon two factors: the assessed value of your property and the dollar amount levied by units of government.

The appeal process begins at the local level. When going through the appeal process, you, the property owner, are appealing the assessed value of your property, not the tax bill. The amount of the tax bill is determined by the various tax rates that are applied to the assessment based on the levies of various local government taxing districts which include counties, townships, municipalities, school districts, special districts, etc. If your assessment changes, these changes must be published in a local newspaper, and notices will be mailed to the homeowner.

Note: Tax rates are not an issue in the assessment appeal process, only the amount of the assessment.

Appeal Process

If

you do not think your assessment is correct, please contact the

Decatur Township Assessor’s Office. We

are happy to sit down with you and listen to your

concerns. The following information will help you be prepared for

the meeting, and will help us understand the situation better.

·

Recent purchase contracts, listings, and closing statements of your

property

·

Sales of similar homes in your neighborhood

·

Assessments of similar homes in your neighborhood

·

Recent appraisal of your property

·

Photographs of your home and comparable properties in your

neighborhood

You can gather comparable sales and assessment information by researching similar properties via our website at www.Decaturtownshipassessor.com. If you need assistance, you may call or visit our office and a knowledgeable staff member will be happy to help you through the process.

Complaints may be based on the following objections.

·

Incorrect data – Information about your property is incorrectly

reported on the Assessor’s property record card.

Errors in square footage or numbers of bathrooms in the home

are some examples.

·

Market Value – Based on comparable sales in the area, your house

would sell for less than the Assessor’s opinion of value

·

Inequity – The market value of your property is accurate, but

similar properties are assessed for less.

After your meeting with the Decatur Township Assessor’s Office, if

you are not satisfied with the Assessor’s decision, you may file an

appeal with the Macon County Board of Review. At the appeal hearing

you will present your information to a three member panel.

For more information about the Macon County Board of Review,

go to

https://maconcounty.illinois.gov/downloads/#board-of-review.

You may discuss your assessment with the Decatur Township Assessor’s

Office throughout the year.

However, appeals to the Board of Review must be filed within

30 days after the publication of the assessment in the Decatur

Herald and Review which is published in the fall of each year.

After receiving notice of the Board of Review’s decision you

have thirty days to appeal to the State Property Tax Appeal Board.

Remember, most misunderstandings on your assessment may be answered by a simple phone call or by furnishing supporting data to the Decatur Township Assessor’s Office. If you would like to set up an appointment with the Decatur Township Assessor’s Office, you can call our office at (217) 428-3479.

View and Print your Property Record Ca rds at your convenience.Propert

rds at your convenience.Propert

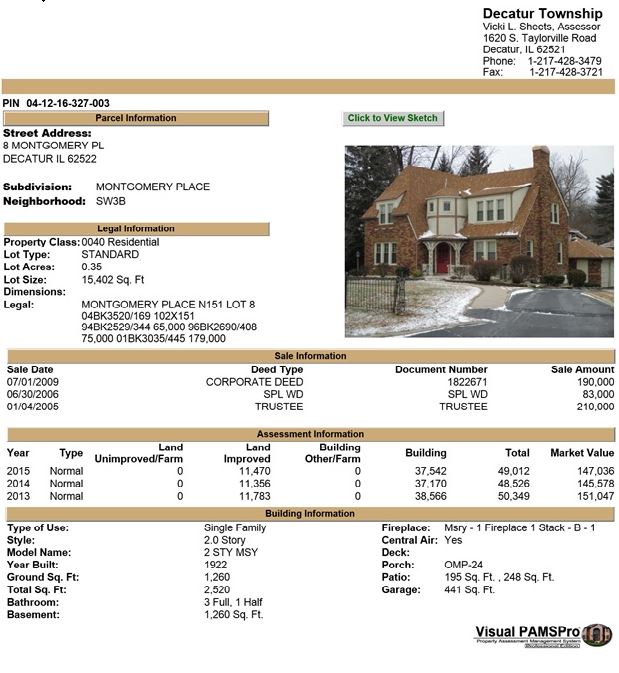

Decatur Township Property Record Card